June 22nd

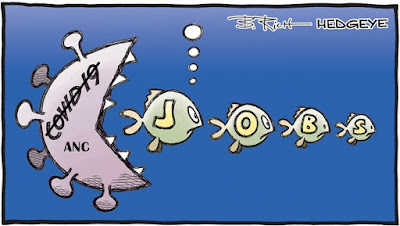

The chart is seen to indicate the potential for further downside which the alternative count, as previously explored, would support. It can arise from the evaporation of the negative sentiment towards a second wave of Covid-19. I would be happier to get Primary wave [4] into the rear view mirror. There should be similar downside potential with spot gold and the major gold miners and a prospective strengthening of the Rand/USD.

plantationis semina

June 15th

The markets have moved into rarely, if ever seen territory. But this is just a continuation of the abuse and related malfeasance of the self-legalized modern mafia. Technical analysis is consequently being challenged like never before.

There is always a need to challenge your own view and to do so persistently. It is natural and easier to adopt a stance and to then defend it by your own bias. You do not become schizo until you lose control. So I try not to lose it or abuse it.

Wave (4) has the appearance of a normal corrective pattern. Accordingly the present action is seen as wave [ii] which is finding support at the 62% retrace level. Unless the Fed and/or associates go even more berserk that is.

29th May:

A review of the progress of the current Cycle indicates the probability that Primary wave [4] has already completed. An examination of Primary wave [3] reveals that it extended following an unacceptable (fake) attempt to conclude whilst breaking the hard rule that the 4th wave may not enter the 1st wave of the same order. If it were not for this rule we would be misled into assuming that the Cycle was already complete. It is also noted that Primary wave [4] is 0.62 of [2] which is often seen in high momentum developments. Adopting this view places the current move up as Intermediate wave (1) of Primary wave [5]. This will confirm provided that the future wave (2) does not dip below [4].

It follows from the above that the previous hourly chart (2nd chart below) requires that (4) becomes [4] and that [3] becomes (1) as is now indicated in the first chart below. The re-arrangement of the internal furniture does not change the target.

From earlier same day:

This hourly view of the Gold Mining Index is showing the progress and target of Intermediate wave (5). A small dip is now expected as the fledgling uptrend is partially retraced, the completion of which is expected to be the entry point for the run up to the top of Primary wave [3]. I apply this to the major listings of this index with a 15 minute view. Make sure you are in total agreement and that you know how to trade with safety before acting on this sort of half-educated guesswork.

The purpose of sharing this is to encourage broader interest with the application of the Elliott Wave theory.

The standard version of the theory applies.

My Wave Numbering

tyrannicas introducamus

No comments:

Post a Comment